- INJ’s T-Mobile partnership boosts institutional infrastructure narrative; AI token leadership drove prior 12% rally.

- Cross-chain DeFi modules (Ethereum, Cosmos, Solana) attract developers; $11.50–$11.20 risk if $12.25 fails.

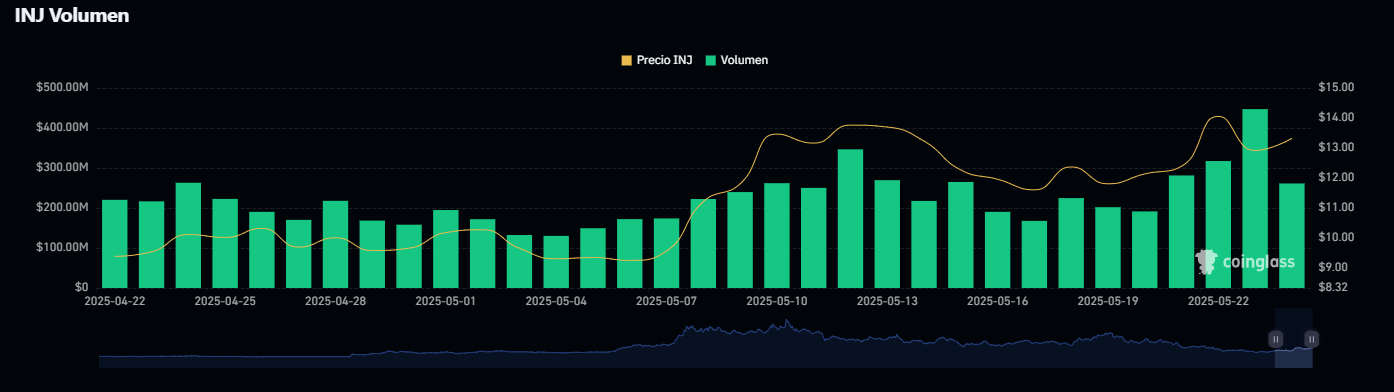

Injective (INJ) is currently trading at $12.49, down -8.26% over the last 24 hours and -0.91% over the past 7 days, reflecting a sharp short-term correction following a period of bullish momentum.

With a market capitalization of $1.22 billion, INJ is ranked #86 globally. The current 24-hour trading volume is $117.9 million, though volume has dropped more than 26%, indicating a pullback in speculative trading activity.

Technically, INJ is trading near key support levels around $12.25–$12.40. If this level fails, INJ could retrace toward $11.50–$11.20. On the upside, a breakout above $13.00 with renewed volume could target $14.20–$15.00, especially if sentiment improves and capital rotates back into DeFi tokens.

Recent Market Highlights:

- INJ has completed an inverse head-and-shoulders pattern, with analysts targeting a potential breakout toward $17, should macro and market conditions stabilize.

- Injective is actively expanding its role in the AI token sector, reportedly leading the segment with a recent 12% surge prior to the current pullback.

- A high-profile collaboration between Injective and T-Mobile was announced, aimed at developing an on-chain future for financial applications, boosting the narrative of institutional-grade infrastructure.

Injective remains a key DeFi-focused Layer 1 protocol, with cross-chain compatibility across Ethereum, Cosmos, and Solana ecosystems. It offers modules for building decentralized exchanges, derivatives markets, and synthetic assets — a model that continues to attract developers and institutions alike.

If INJ holds above $12.25 and breaks $13.00 with increased volume, it is projected to reach $14.80–$15.60 within 6–8 days, fueled by Layer 1 DeFi interest, AI infrastructure demand, and bullish technical patterns.

Disclaimer: ETHNews does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to cryptocurrencies. ETHNews is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned.