17h05 ▪

3

min read ▪ by

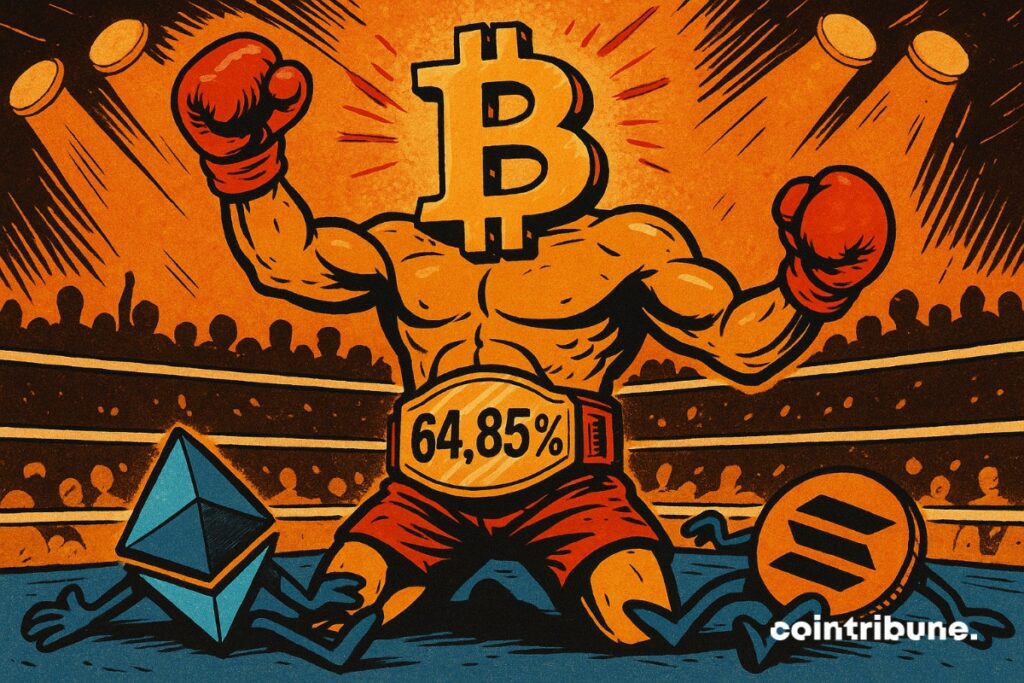

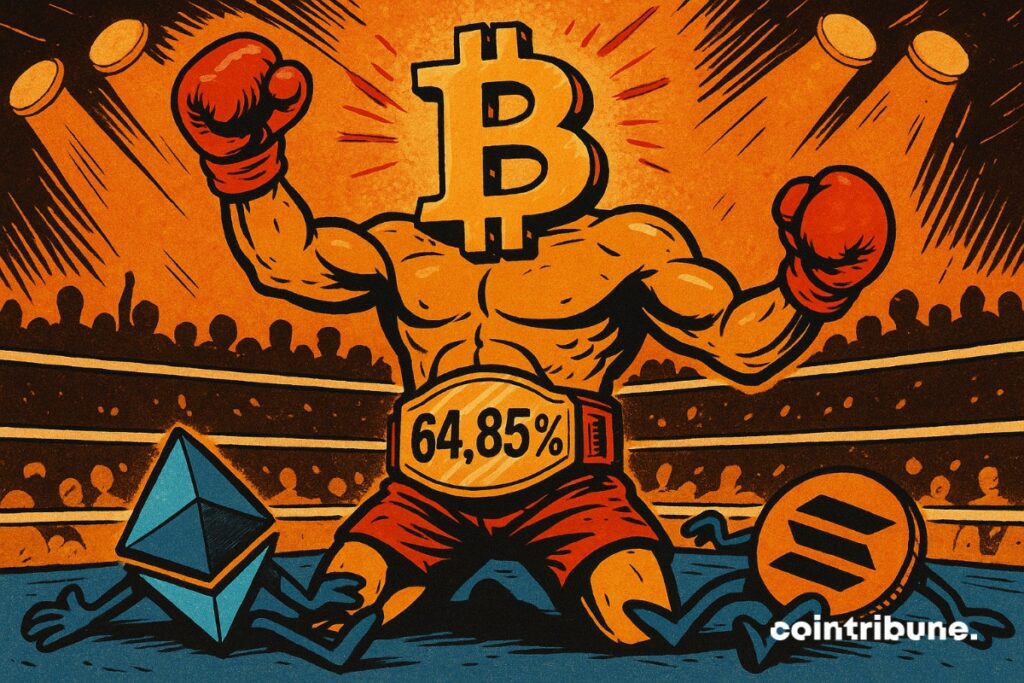

Bitcoin strikes hard: with a price flirting with $97,000 and a market dominance of 64.89%, the crypto queen reaches its highest level since 2021! Driven by distrust towards altcoins and a tense macro environment, BTC crushes the competition and attracts capital.

In Brief

- Bitcoin reaches a dominance of 64.85%, a record since 2021, driven by a price close to $97,000.

- The unstable macroeconomic context and Trump’s policies strengthen its safe-haven status against altcoins.

- The massive inflow of capital via bitcoin ETFs fuels potential dominance beyond 70%.

Bitcoin: Market dominance reaches a 4-year peak

In a few months, Bitcoin’s dominance has risen from 57.90% in December 2024 to nearly 65% this Saturday, its highest peak in 4 years. While BTC trades around $97,000, this progression marks a strong comeback of the king asset in a crypto market undergoing upheaval.

Two key factors explain this spectacular rise:

- An uncertain macroeconomic context: investors fleeing traditional assets like U.S. Treasury bonds have strengthened Bitcoin’s appeal, considered a more resilient store of value amid global economic tensions.

- Trump’s tariff policy: the imposition of higher tariffs by the U.S. administration has created an unstable climate, cooling appetite for more speculative altcoins. Conversely, Bitcoin stands out, benefiting from its safe-haven image and proven infrastructure.

A unique resilience in an uncertain market

David Morrison, senior analyst at Trade Nation, explains that bitcoin benefits from a first-mover advantage, more favorable regulation, and a strictly limited supply, which attracts both institutional and retail investors.

Even during bearish periods, bitcoin shows an impressive ability to rebound, unlike many altcoins that are still struggling.

While the Bitcoin ETF has attracted 4 billion dollars more than the gold ETF this week, institutional confidence seems to be strengthening. This could propel BTC beyond 70% dominance if this trend continues.

As bitcoin establishes its supremacy in the crypto market, its breakthrough worries some regulators. The Bank of Italy warns about the systemic risks of integrating BTC into national reserves. A rise in power that fascinates… but could also reshuffle the cards of global stability.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.