20h05 ▪

4

min read ▪ by

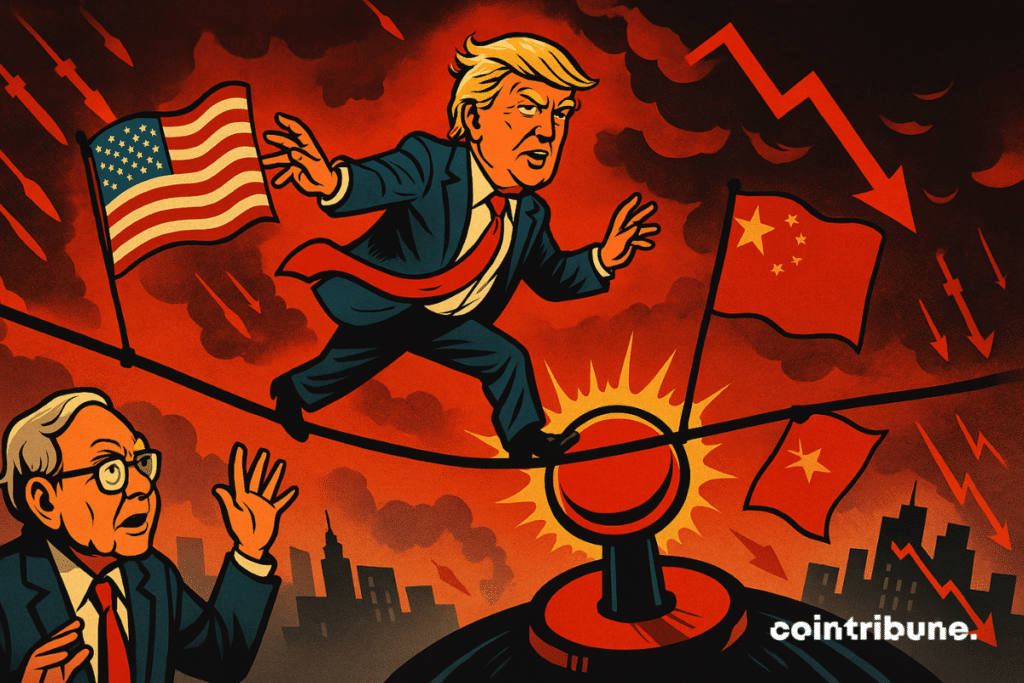

What if a trade war could lead to a nuclear confrontation? The hypothesis seems extreme until it is raised by Warren Buffett. Indeed, during Berkshire Hathaway’s annual meeting, the investor warned that Donald Trump’s economic policies, perceived as aggressive, could fuel global tensions with uncontrollable consequences. An unusual stance, heavy with implications, in an international context already weakened by growing rivalries.

In brief

- Warren Buffett raises the alarm. He believes Donald Trump’s trade policies could trigger a nuclear confrontation.

- In an unstable and armed world, Buffett considers it dangerous to wage a trade war based on unilateralism.

- He implicitly criticizes Trump’s protectionist approaches, especially towards China and the European Union.

- He calls for political and economic decision-makers to become aware of the potential implications of their actions.

Buffett facing the risk: an alarmist or clear-eyed vision?

During a public intervention, the emblematic investor Warren Buffett raised the alarm concerning the potential geopolitical consequences of a tightening of trade policies.

He stated straightforwardly:

It is dangerous to push current trade policies in a world filled with nuclear weapons.

By targeting Donald Trump without naming him, Buffett evokes the specter of a world where economic confrontation logics would replace diplomacy, with a risk of escalation far beyond a simple trade clash.

Buffett’s statements fit into a global analysis of the international context. He warns about the domino effect that certain aggressive trade strategies can provoke, especially when applied to nuclear powers. Here are the key points highlighted or implied by his remarks:

- An implicit criticism of Donald Trump’s policies, known for their unilateral and protectionist approach towards China or the European Union;

- A warning about the risks of global instability, in an environment already tense due to rising nationalism and nuclear proliferation;

- A reflection on the strategic impact of international trade, which can exacerbate diplomatic tensions when it becomes instrumentalized as a pressure tool;

- An indirect call to the responsibility of decision-makers, so that they consider the global consequences of their economic decisions in an interconnected and potentially explosive world.

Buffett, rarely inclined to take political stances, adopts here an almost geostrategic posture. This tonal shift highlights the seriousness of the moment and the need for an economic and security reading of international dynamics.

A tension ignored by the markets?

Buffett did not stop at a theoretical warning. He also pointed out that markets, obsessed with the short term, often ignore the “weak signals” of deep tensions. “People do not realize the risks this entails,” he indicated.

Moreover, he highlights the blindness of some economic actors to underlying geopolitical dynamics. For him, trade decisions cannot be separated from their broader strategic implications, especially when nuclear powers are involved.

This statement fits into a holistic view of modern interdependencies. Buffett, as an investor, does not only alert to abstract risks, but to concrete dynamics that could unbalance global trade flows, weaken diplomatic agreements, and undermine the stability of both traditional markets and cryptocurrencies. This is a reminder: economic policies are never neutral, especially when driven by a unilateral logic.

In the longer term, this statement could mark a turning point in how the financial sector perceives geopolitical issues. The idea that the trade war could be a stepping stone to a larger conflict is no longer the domain of geostrategic analysts alone but also of leading investors. It remains to be seen whether markets, often insensitive to long-term warnings, will take this caution seriously.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d’une certification consultant blockchain délivrée par Alyra, j’ai rejoint l’aventure Cointribune en 2019.

Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l’économie, j’ai pris l’engagement de sensibiliser et d’informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu’elle offre. Je m’efforce chaque jour de fournir une analyse objective de l’actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.