- Whale sell-off reflects profit-taking post-airdrop; retail traders may drive rebound if support holds.

- Pudgy Penguins’ active community, exchange liquidity may counter whale exits; next 48 hours critical for trend.

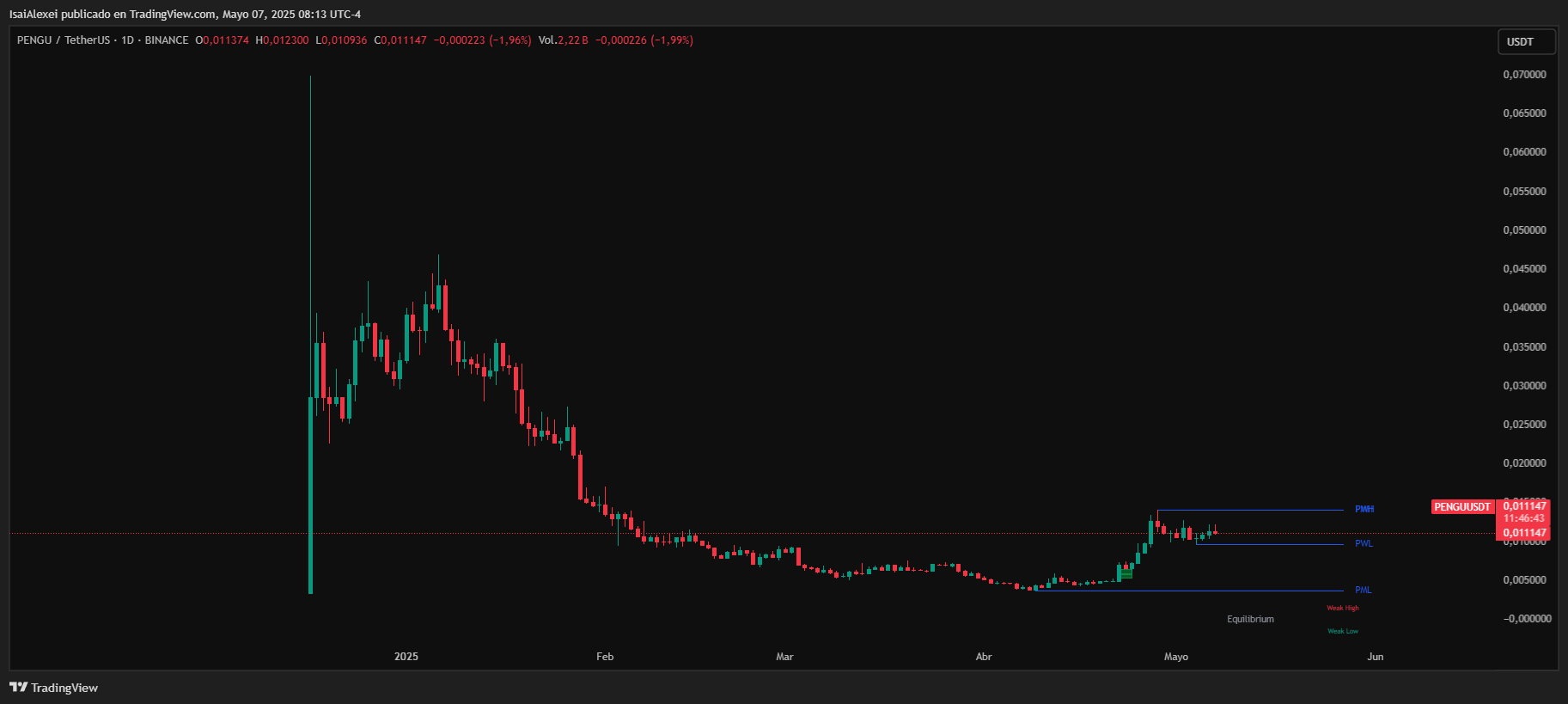

The PENGU token, tied to the Pudgy Penguins NFT collection, has seen a sharp decrease in value after large investors sold holdings worth millions. On-chain data shows Sigil Fund, a major holder, moved 52 million PENGU tokens to exchanges, contributing to a nearly 50% price drop from recent peaks. The token now trades at levels last observed weeks ago, raising questions about its short-term stability.

ETHNews technical analysts, however, suggest the sell-off may not signal long-term decline. Charts indicate PENGU is forming a bullish triangle pattern, a setup often preceding upward price movements. Traders note the $0.010559 level as a key support zone. If buying pressure stabilizes the token above this threshold, projections based on historical patterns point to a potential climb toward $0.01596—a 42% increase from current prices.

Traders analysts argue the whale activity reflects profit-taking rather than abandonment. PENGU recently gained attention after its Binance listing and a token airdrop, events that typically prompt early investors to secure gains. Crypto analyst @ChartPengu described the situation as a “reset,” noting that retail traders could now drive demand if confidence in the token’s utility persists.

The token’s connection to Pudgy Penguins, a well-known NFT brand with a dedicated following, may cushion further declines. Community engagement remains active, and exchange listings continue to provide liquidity.

Still, the immediate outlook hinges on whether smaller buyers step in to absorb selling pressure near the $0.010559 floor. Rules-based traders are monitoring volume shifts closely, as a breakdown below support could invalidate bullish assumptions.

While whale exits often unsettle markets, PENGU’s technical posture and underlying brand strength offer a counter-narrative. The next 48 hours will test whether the token’s design—a blend of meme culture and speculative appeal—can withstand concentrated selling and reignite upward momentum.

Disclaimer: ETHNews does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to cryptocurrencies. ETHNews is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned.